Facts About Annual Percentage Rate

When an individual shops around for a new motor vehicle, he/she will constantly hear the term "APR." Car commercials proudly display APR costs and make it a point to emphasize a low APR. Despite the prevalence of the term, many individuals are still uncertain of its meaning.

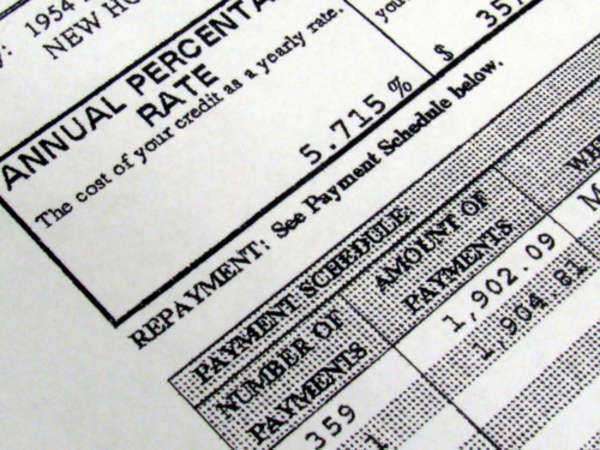

APR, or annual percentage rate, refers to the amount of interest that a debtor will be required to pay on a loan every year. Understanding this term is not just important when purchasing a motor vehicle. Credit cards, home mortgages, and most other types of loans all have an annual percentage rate attached.

A lender grants an applicant a loan based on the premise that he/she will repay the loan plus interest. The debtor will pay the principle to cover the initial value of the loan and the interest that is paid, which serves as the profit to the creditor.

The annual percentage rate will vary from one loan to another, as well as from one borrower to another. If an individual has warranted a sub-par credit history as a result of failure to regularly pay previous debts, the annual percentage rate that is attached to a loan secured by him/her may be higher than the APR of other debtors.

A higher annual percentage rate may cause complications for an individual that has previously experienced trouble repaying his/her debts. A high APR will result in larger monthly payments.

If a debtor is having financial difficulties, high monthly payments will make it more difficult for a debtor to meet his/her financial obligations, and he/she will end up paying the lender much more money than the initial value of the loan. Therefore, it is important for an individual to research different lenders in order to find the lowest possible APR.

Interest payments are incorporated into a borrower's monthly payments. In the case of credit cards, if an individual makes manageable purchases and pays off the debt every month, the interest that he/she is required to pay will generally be more reasonable. However, if the borrower maxes out his/her credit card and makes only the minimum payment every month, he/she will end up paying a notable amount in interest.

The longer a loan duration, the more interest an individual will be required to pay on the loan. For example, if a borrower accumulates a debt of $2,000 and is required to pay 7% APR, he/she will save a great deal of money if the debt is paid off quickly. It the borrower only pays a small portion of this debt each month, he/she will be required to pay a certain percentage of interest every month that the debt remains.

Failure to make timely monthly payments will result in higher interest rates. An individual that has a positive credit history may enjoy an APR as low as 7%. However, if a debtor fails to make his/her monthly payments on time, the interest rate may rise to over 27%.